Military MRO Salary Expectations in the Middle East: Insights Across 5 Trades, 4 Aircraft Platforms, and 5 Countries

Introduction: Why This Matters Now

Technical labour shortages in aviation are no longer a regional anomaly—they are a global constraint. As fleets age, aircraft utilisation grows, and geopolitical pressures stretch defence resources, the demand for skilled MRO personnel continues to outpace supply. Nowhere is this more visible than in military maintenance across the Middle East, where operators are trying to scale capability with limited access to credentialed and experienced technicians.

Against this backdrop, Airmen Technical Services conducted a focused survey to understand how current and prospective Military MRO workers view opportunities in the region. The findings reflect current attitudes and compensation expectations across key trades and platforms.

We gathered responses from five core trades:

- Electrical/Avionics Technicians

- Powerplant Mechanics

- Crew Chiefs

- Sheet Metal/Structures Technicians

- Aircraft Fitters/Systems Technicians

Each respondent had experience on at least one of four major military aircraft platforms:

- C-130

- C-295

- CH-47 (Chinook)

- UH-60

And they were asked about their willingness to work in five key locations:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Oman

- Jordan

The insights below are designed to support both hiring organisations and deployed personnel in navigating compensation, deployment decisions, and market dynamics.

Location Preferences

The UAE was the most selected destination, with 89% of respondents favouring it. Saudi Arabia (44%) and Qatar (41%) followed. Oman (8%) and Jordan (3%) received limited interest.

For organisations recruiting outside the UAE, more targeted offers may be necessary to attract interest.

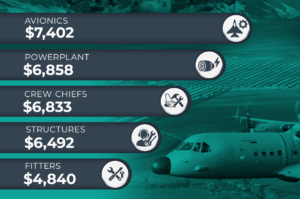

Salary by Trade

Average monthly salary expectations by role:

- Electrical/Avionics Technicians: $7,402

- Powerplant Mechanics: $6,858

- Crew Chiefs: $6,833

- Sheet Metal/Structures Technicians: $6,492

- Aircraft Fitters/Systems Technicians: $4,840

Avionics specialists report the highest expectations, driven by the diagnostic complexity and fast-evolving nature of their systems work. Fitters, while reporting lower average pay, play a foundational role in day-to-day maintenance operations, often handling high volumes of task-critical activity. Crew Chiefs and Powerplant Mechanics sit in the middle of the range, typically balancing broad system oversight with practical line-level execution. Across all roles, expectations tend to align with both the certification requirements and the degree of technical independence expected on deployment.

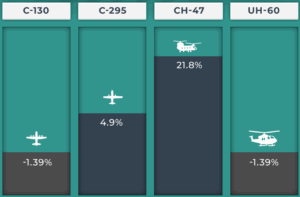

Impact of Platform Experience

Average salary expectations increase with platform complexity:

- CH-47 (Chinook): +21.8% above average

- C-295: +4.9%

- C-130 and UH-60: Slightly below average

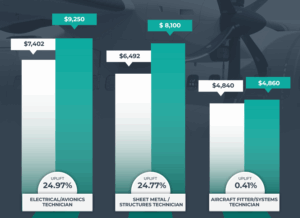

Two roles show especially high uplift when tied to CH-47 work:

- Avionics Technicians: $9,250 (+25%)

- Structures Technicians: $8,100 (+25%)

For roles involving Chinook support, higher expectations should be anticipated. The CH-47 consistently drives a premium across the dataset, particularly among Avionics and Structures personnel. This is likely due to a combination of operational complexity, platform age, and global deployment patterns.

Technicians supporting the CH-47 are typically required to navigate hybrid configurations, legacy systems, and country-specific variants. In many cases, these aircraft are operating well beyond original service life forecasts, creating additional inspection burdens and non-routine work. The platform is often deployed in high-tempo or austere environments, where prior experience directly supports aircraft availability, operational readiness, and safety outcomes.

As a result, qualified Chinook personnel often command higher pay, reflecting both the scarcity of platform-specific experience and the reliability risk that operators face when sourcing capability.

Effect of Experience

Respondents with 10 or more years of experience reported salaries approximately 3% higher than their less-experienced peers. The gap was most evident in:

- Electrical/Avionics: $7,636 vs $7,402 average (+3.2%)

- Sheet Metal/Structures: $6,685 vs $6,492 average (+3.0%)

In the case of Electrical/Avionics Technicians, the premium likely reflects the pace of systems evolution and the value of real-world diagnostic experience. Technicians with a decade or more in the field tend to have exposure to multiple platform variants, legacy avionics, and integration issues that are difficult to simulate in training. Their ability to troubleshoot under operational time pressure makes them particularly valuable in high-tempo or minimal-support environments.

For Sheet Metal/Structures Technicians, the uplift may be tied to their practical familiarity with fatigue-prone airframes and the nuances of structural repair in aging military platforms. Experienced structures personnel are often called upon to make judgment calls on borderline damage or to adapt repairs in the field when OEM instructions fall short. This accumulated tacit knowledge isn’t easily replaced by certification alone.

In other trades, experience did not significantly affect expected pay; possibly because many tasks are more procedural or more easily standardised through type training and documentation.

Employment Preferences

Preferences for employment type were as follows:

- 31% preferred contract roles

- 17% preferred permanent employment

- 52% were open to either

Sheet Metal/Structures Technicians showed the strongest preference for contract work (65%). The data doesn’t confirm a specific reason, but the pattern is clear and consistent. It may reflect the nature of work patterns or deployment types common in this trade, but further research would be needed to draw a firm conclusion.

Contract Salary Uplifts

Workers who prefer contract roles typically expect to be paid more. This is a consistent pattern across the aviation industry and holds true in the Middle East MRO market as well.

In our data, contract roles were associated with uplifted salary expectations across all surveyed trades:

- Aircraft Fitters: $5,858 vs $4,840 (+21%)

- Avionics Technicians: $10,280 vs $7,402 (+39%)

- Powerplant Mechanics: $6,930 vs $6,858 (+1%)

- Structures Technicians: $6,722 vs $6,492 (+4%)

The scale of uplift varies, but the underlying principle remains the same: flexibility, short-notice deployment, and site mobility carry a premium. Contractors are often expected to integrate quickly, work independently, and adapt to unfamiliar operating environments with minimal support. This is priced in.

It is not surprising, then, that contract expectations sit above the average.

Summary

This data set gives a grounded view of what military MRO workers in the Middle East expect—by trade, platform, experience level, and contract model. The variation in salary is not random: it reflects the operational demands, platform complexity, and certification depth that each role carries. Trades like Avionics and Structures, where diagnostic skill or structural judgement is more exposed, show higher uplifts for both experience and platform-specific work. The CH-47, in particular, stands out as a consistent driver of premium expectations.

Contract roles remain widely preferred and predictably come with a pricing differential. This is not unique to the region, but the tempo and operating conditions found across many Middle East projects may sharpen the edges of that expectation.

Location preferences are strong, with the UAE clearly dominant. This is not, however, a proxy for salary: where people want to work and what they expect to be paid are shaped by different variables.

There are no big surprises here; just confirmation of patterns that many in the sector already sense. But now they’re quantified, benchmarked, and ready to inform decisions. Airmen Technical Services supports operators, regulators, and partner organisations across civil and military aviation. From technical authorship to market intelligence, training strategy to capability audits – we provide practical insight and delivery support for demanding programmes, delivered locally; globally.

To explore how we can assist your organisation, reach out via [email protected].