The aviation industry in the Middle East is undergoing transformative change with the UAE and Saudi Arabia leading the expansion of Maintenance, Repair, and Overhaul (MRO) capabilities. This growth aligns with broader economic diversification strategies for the region, such as Saudi Arabia’s ‘Vision 2030’ and UAE’s ambition to position itself as a global aviation hub. However, this rapid expansion presents significant challenges, particularly in recruiting and retaining skilled aircraft technicians, who are a critical component in sustaining this growth.

Already, the global aviation industry is facing a significant shortfall in skilled technicians, which was exacerbated during COVID, when thousands were laid off or decided to transfer their skills to other industries. The International Civil Aviation Organization (ICAO) projects that by 2026, an additional 480,000 technicians will be required to maintain the aircraft fleet worldwide . In particular, this shortage is acutely felt in the Middle East, where the rapid growth of MRO services has outpaced the availability of qualified personnel. In this blog, we will explore these challenges in more detail.

UAE: A global aviation hub

The UAE has firmly established itself as a leader in the Middle Eastern MRO market. As of 2023, the emirates commands approximately 45% of the region’s total MRO demand. This dominance is attributed mainly to strategic hubs in Dubai and Abu Dhabi, which are the bases for Dubai Aerospace Enterprise Engineering, Emirates Engineering and Etihad Engineering respectively. These aviation titans have all made major investments in MRO infrastructure, with Emirates recently announcing a $950 million investment in a state-of-the-art engineering and paint facility at Dubai World Central. Additionally, Etihad Engineering has expanded its training facilities near Abu Dhabi International Airport to train up to 18,000 technicians annually.

The UAE’s MRO market has witnessed substantial growth, with revenues reaching USD 3.2 billion in 2022 and an annual growth rate of 12% from 2020 to 2023. More than 60% of all wide-body aircraft maintenance in the region is conducted at UAE facilities. The country’s strategic location has undoubtedly contributed to this success as it sits within an eight-hour flight radius of 80% of the global population.

Government initiatives have also been instrumental in this growth, with investments exceeding USD 2 billion in MRO infrastructure and digital MRO technologies, such as AI-driven predictive maintenance and sustainable practices.

Saudi Arabia: Vision 2030 and MRO Village

Saudi Arabia is making equally ambitious strides under its Vision 2030 framework. The country is investing up to $100 billion in aviation infrastructure, including new airports and airlines. A flagship project is the MRO Village near King Abdulaziz International Airport in Jeddah. Backed by the Saudi Public Investment Fund (PIF), this world-class facility aims to serve both domestic and international markets, positioning Saudi Arabia as a global MRO hub.

Drivers of MRO expansion

Several factors are fuelling the growth of MRO services in the UAE and Saudi Arabia:

- Fleet expansion: Both countries are rapidly expanding their commercial aircraft fleets. Saudi Arabia alone has 278 active airliners with an additional 350 on order from Boeing and Airbus. Newer carriers like Riyadh Air are also expected to place significant orders.

- Ageing aircraft: As fleets age, demand for maintenance services increases. This trend is being compounded by existing delays in new aircraft deliveries.

- Technological advancements: Latest generation aircraft like the Boeing 787 and Airbus A350 require specialized maintenance capabilities

- Economic diversification: Both nations are leveraging aviation to diversify their economies away from oil dependency, making MRO a key strategic focus.

Challenges for recruitment and retention

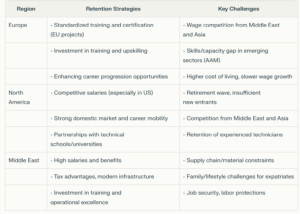

The Middle East has become a magnet for aviation with countries like the UAE and Saudi Arabia ramping up their fleets, launching new airlines and investing heavily in infrastructure and training facilities. This has resulted in the demand for qualified personnel to outstrip supply, making it a highly employee-driven market. Salaries are competitive, often surpassing those in Europe and North America and benefits packages are designed to attract and retain top talent. For instance, the UAE offers average aerospace engineering salaries that rival or exceed those in Western countries, thanks to its strategic investments and ambitious projects.

But this rapid expansion of MRO services has exposed a shortage of skilled labour in all regions. According to industry estimates, the global aviation sector will need 585,000 new technicians by 2041 to meet demand. Competition for aviation engineers is, therefore, intense. Airlines are increasingly hiring technicians directly from training programmes or even poaching talent from independent MROs. These tactics, often necessary for a company to survive, disrupt traditional career pathways, in which technicians would gain experience at smaller MROs before moving on to work for larger airlines.

The European market, in particular, faces a tight labour market for aviation engineers. The continent’s established hubs, in the UK, Germany, France and Italy, are struggling with rising wages and competition from the Middle East and APAC. There is also a widening skills and capacity gap, particularly as new sectors like Advanced Air Mobility (AAM) emerge. Efforts such as standardized training frameworks and cross-border recognition of qualifications are underway to make the European aviation job market more flexible and attractive.

Across the Atlantic in the USA, the presence of Boeing and Lockheed, major aerospace supply chain companies, high salaries and a large domestic air travel market, has helped the region to dominate for many years. However, the region faces its own challenges, not least a looming retirement bubble and a shortage of new entrants into maintenance and engineering. Companies are ramping up recruitment and training efforts but the gap between demand and supply persists.

Training for the future

Training facilities require significant investment in infrastructure and technology. Moreover, regulatory requirements for training programmes vary across countries. For instance, Etihad Airways Engineering operates a Part 147 training facility but acknowledges that scaling up its training capacity remains a challenge. It has increased its training capacity and plans to establish a new technical training facility adjacent to Abu Dhabi International Airport. This aims to boost its training capacity from approximately 600 to over 1,000 courses annually, accommodating more than 18,000 trainees.

Lufthansa Technik Middle East (LTME) is collaborating with Saudia Technic to launch a joint training scheme. This initiative involves hosting Saudia technicians at LTME’s Dubai and Hamburg facilities, focusing on component repair for Boeing 777 and 787 and Airbus A320 aircraft. Saudia Technic is addressing the labour shortage by building a training academy at its MRO Village in Jeddah. This academy aims to provide guaranteed jobs for graduates, ensuring a sustainable talent pipeline.

Beyond recruitment, retaining skilled technicians is also crucial if long-term expansion is to be sustained in the region.

For example, Joramco, an independent MRO based in Jordan, has implemented a forward-looking employee engagement scheme to maintain low attrition rates. By offering comprehensive packages that address career development and work-life balance, Joramco has achieved attrition levels that many companies in North America and Europe aspire to.

Collaboration between governments, airlines, OEMs (Original Equipment Manufacturers), and MRO providers is also critical. For example:

- Lufthansa Technik Middle East has partnered with Saudia Technic to provide hands-on component repair training.

- Airbus has collaborated with Mubadala Investment Co. to offer internships for UAE engineering students.

- Initiatives to diversify the workforce to encourage more women into the sector. Etihad reports that women now make up a significant portion of its engineering graduate programme.

- Technological advancements such as AI-driven predictive maintenance tools and virtual reality-based training to attract school leavers interested in working with cutting-edge technologies.

Conclusion

The expansion of aircraft MRO services in the UAE and Saudi Arabia represents a significant opportunity for economic growth and global positioning within the aviation sector. However, this growth comes with challenges, most notably the acute shortage of skilled technicians.

Addressing this issue will require a multi-faceted approach involving investments in training infrastructure, public-private partnerships, technological innovation and workforce diversification. The aviation boom in the Middle East is intensifying the global competition for skilled engineers and technicians. Europe and North America must innovate in compensation, training and career development to retain their talent in the face of lucrative offers and appealing lifestyles abroad. Collaboration between industry, governments and educational institutions will be vital to ensure that the regions remain attractive and competitive.

By tackling these challenges head-on, the region can solidify its status as a global leader in aviation maintenance whilst creating sustainable employment.

Airmen Technical Services is a specialist consultancy and brokerage of high calibre expertise in maintenance, repair, and modifications of fixed wing and rotary aircraft, utilising a global network of professional organisations and highly skilled freelance engineers.

If you are a qualified aircraft engineer or maintenance and repair organisation(MRO) who is interested in joining the Airmen network, click HERE for more information.